- High claim hold volumes – driven by outdated adjudication systems – are often caused by coding errors, incomplete documentation, or missing data. These issues trigger manual intervention and delayed reimbursement.

- Reliance on manual claims processing leads to time-consuming workflows, increased errors, and operational inefficiencies, diverting resources away from patient care.

- Disparate healthcare IT systems create inefficiencies and data silos, requiring significant investments to enable seamless integration and improve claims management – hence the need for modernization.

Our Advice

Critical Insight

- The significant financial investment and need for skilled personnel required to modernize legacy claims systems can be prohibitive, especially for health plans with tight budgets.

- The challenge of ensuring seamless interoperability between legacy and modern systems can lead to operational disruptions, making CIOs hesitant to pursue system upgrades.

- Modernizing claims adjudication systems carries risks such as downtime, data migration challenges, and workflow disruptions, potentially impacting claims processing efficiency.

Impact and Result

- Identify the market trends of claims adjudication systems and business benefits.

- Determine the business needs and key capabilities of modern claim adjudication systems.

- Analyze system features and vendors in the market to help achieve desired outcomes.

- Leverage Info-Tech’s Health Insurance Claims Adjudication Evaluation and Scoring Tool to get started.

Modernize Your Claims Adjudication System: A Buyers Guide

Select the right solution to streamline workflows, increase adjudication accuracy, and improve payer-provider collaboration.

Analyst perspective

Upgrade now to reduce rework and boost performance.

The rising urgency to modernize healthcare claims adjudication systems is driven by persistent challenges rooted in outdated platforms – namely volumes of claim holds, coding errors, incomplete documentation, and manual intervention. These inefficiencies not only delay reimbursement but also redirect resources away from core patient care delivery. In many cases, disparate IT systems further fragment claims operations, leading to data silos and costly integration efforts.

Despite growing interest in modern solutions, many health payers remain hesitant due to the financial investment required and concerns over operational risk, including downtime, data migration hurdles, and interoperability between legacy and modern systems. Moreover, health plans operating on limited budgets often lack the skilled personnel and technical readiness needed for a seamless transition.

As payers seek to align their digital transformation efforts with emerging market demands - such as automation, compliance, and real-time adjudication – they must carefully assess vendors, features, and scalability. This buyer's guide aims to simplify that process by helping organizations identify their most pressing needs, explore modern capabilities, and evaluate vendor offerings.

Sharon Auma-Ebanyat

Research Director, Healthcare Industry

Info-Tech Research Group

Executive summary

| Your Challenge | Common Obstacles | Info-Tech's Approach |

|

High claim hold volumes - driven by outdated adjudication systems - are often caused by coding errors, incomplete documentation, or missing data. These issues trigger manual intervention and delayed reimbursement. Reliance on manual claims processing leads to time-consuming workflows, increased errors, and operational inefficiencies, diverting resources away from patient care. Disparate healthcare IT systems create inefficiencies and data silos, requiring significant investments to enable seamless integration and improve claims management - hence the need for modernization. |

The significant financial investment and need for skilled personnel required to modernize legacy claims systems can be prohibitive, especially for health plans with tight budgets. The challenge of ensuring seamless interoperability between legacy and modern systems can lead to operational disruptions, making CIOs hesitant to pursue system upgrades. Modernizing claims adjudication systems carries risks such as downtime, data migration challenges, and workflow disruptions, potentially impacting claims-processing efficiency. |

|

Info-Tech Insight

Modernizing claims adjudication is no longer optional - rising inefficiencies and financial strain demand action. Assess your processes, identify gaps, and choose the right upgrade path before making a move.

Streamline operations with a closer look at claims adjudication systems

A healthcare claims adjudication system is a specialized software solution that enables insurance payers to evaluate and process medical claims submitted by healthcare providers. This system determines the insurer's payment responsibility by assessing the validity, accuracy, and eligibility of claims against the terms of the insurance policy.

Claims adjudication systems offer many key features, including but not limited to:

- Rule-based automation

- Electronic data interchange (EDI)

- Claims adjudication workflows

- Manual intervention and exception handling

- Basic analytics and reporting

- Regulatory compliance controls

- Interoperability with legacy systems

- Claims tracking and status updates

- Audit trails and security measures

- User-friendly interfaces

Info-Tech Insight

Healthcare claims adjudication systems are evolving with AI and automation, improving efficiency but increasing automated denials. Prioritize alignment with operational needs and compliance over industry trends when selecting a modern system.

Seamless claims adjudication starts with smart integration

Before selecting a claims adjudication system, ensure it integrates seamlessly with your EHR, billing, and compliance systems to streamline workflows and reduce inefficiencies.

With numerous claims management solutions available, payers and providers must identify essential features like automation, real-time adjudication, AI-driven fraud detection, and regulatory compliance.

The challenge is optimizing efficiency and accuracy without disrupting operations. Take a strategic approach to technology selection, prioritizing scalability, compliance, and seamless data exchange for a cost-effective, efficient claims process.

| STAKEHOLDERS | ||||

|---|---|---|---|---|

| Insurance Companies (Payers) | Healthcare Providers | Patients (Members) | Administrators | Brokers and Third-Party Administrators |

| SYSTEMS OF ENGAGEMENT | |||

|---|---|---|---|

| Member Portals | Provider Portals | Payer Systems | Claims Management Systems |

| TRANSACTION PROCESSING and DATA EXCHANGE | CLAIMS ADJUDICATION AND PROCESSING |

|---|---|

|

|

| PAYMENT PROCESSING AND SETTLEMENT |

|---|

|

Reimbursement Processing: Payments to providers |

| EXTERNAL INTEGRATION AND COMPLIANCE |

|---|

|

Regulatory Compliance: HIPAA, data protection laws |

Info-Tech Insight

While fully unified claims adjudication systems are still emerging, payers should prioritize vendors with end-to-end automation, real-time processing, interoperability, and AI-driven fraud detection for a more unified system.

Outdated claims adjudication systems are creating inefficiencies and financial losses

High Volume of Claim Holds

- These are often the result of coding errors, incomplete documentation, or missing or incorrect data, which disrupt autoadjudication and increase manual workloads.

Inefficient Manual Processes

- Operational Challenges: Manual claims processing is labor-intensive, leading to increased errors and delays.

- Resource Allocation: Reliance on manual workflows diverts resources from patient care to administrative tasks.

- Financial Implications: As much as 15 cents of every dollar earned in healthcare goes uncollected due to inefficiencies in revenue cycle management.

Integration Challenges With Existing IT Systems:

- Data Silos: Disparate healthcare IT systems create inefficiencies and hinder seamless data exchange.

- Cost of Integration: Significant investments are required to enable interoperability and improve claims management.

- Technological Barriers: The lack of standardized processes and system architectures complicates integration efforts.

80% or lower is the typical first-pass approval rate for manual claims adjudication, often impacted by human error, outdated systems, and complex benefit structures.

Source: Therapy Brands, 2023

40-50% of healthcare claims are manually processed, delaying approvals and increasing administrative burdens.

Source: Neudesic, 2025

20% of claims require rework due to errors in first-pass adjudication, leading to increased resource use and strained provider relations."

Source: "Current State," HealthEdge, 2024

Replacing manual processing with scalable autoadjudication has benefits

Manual claims adjudication processes hinder operational performance - resulting in lower first-pass approval rates, increased denial volumes, rising administrative costs, and significant delays that limit payer agility, financial accuracy, and provider satisfaction.

Manual Claims Processing

1. Processing Time

Claims processing can take up to 20 days (3Pillar, 2023).

2. Administrative Costs

The administrative cost per claim increased from $43.84 in 2022 to $57.23 in 2023, primarily due to added labor expenses (Premier, 2025).

3. First-Pass Autoadjudication Rates

Manual first-pass approval rates are often 70% or lower, depending on complexity (Premier, 2025).

4. Denial Rates

Denial rates have been reported as high as 15%, with some instances reaching up to 49% (Premier, 2025).

vs.

Autoadjudication

1. Processing Time

Processing time can be reduced to less than 24 hours, with systems capable of handling over 50,000 claims per hour at a 90% accuracy rate (3Pillar, 2023).

2. Administrative Costs

Automation reduces manual handling, leading to significant cost savings.

3. First-Pass Autoadjudication Rates

Advanced autoadjudication systems achieve first-pass rates between 90% and 97%, with accuracy rates exceeding 99% ("HealthRules Payer," HealthEdge, 2024).

4. Denial Rates

Autoadjudication reduces errors and applies rules consistently, resulting in fewer denials.

Automate claims adjudication to cut costs, reduce errors, and accelerate processing

| Key Reason | Details |

| High Administrative Costs | Manual processing increases labor and operational expenses. Automation reduces overhead and improves efficiency. |

| Increased Error Rates | Manual data entry leads to mistakes and claim denials. Automated systems apply predefined rules for accuracy. |

| Fraud and Abuse Risks | Without automated fraud detection, manual review fails to identify irregular billing practices and fraudulent claims. |

| Inconsistencies in Claims Processing | Manual adjudication varies across departments, leading to disparities in approvals and reimbursements. |

| Limited Scalability | Manual systems struggle to handle increasing claim volumes. Automation enables rapid, efficient scaling. |

| Provider and Patient Satisfaction | Delays in claim processing lead to financial strain on providers and frustration for patients. |

| Faster Processing | AI-driven adjudication reduces processing time from weeks to hours, improving efficiency and accuracy. |

Modernize claims systems to maximize efficiency, minimize costs, and fuel innovation

Reduce Claims Holds and Rework

Payers are implementing systems with advanced preadjudication tools and automated error detection.

Enhance Fraud, Waste, and Abuse (FWA) Detection

Adopt modern systems to protect against financial losses and ensure regulatory compliance.

Improve Operational Efficiency and Automation

Reduce administrative costs through the automation of routine claims-processing tasks and reduce technical debt due to under supported legacy systems.

Enhance Data Analytics and Reporting

Upgraded systems are necessary to enable payers to track performance and make informed decisions.

Support Value-Based Care Initiatives

Payers are upgrading systems to track and analyze quality and cost outcome data.

Improve Provider and Member Experience

This is a driver of system upgrades that offer real-time access to claims information and enhanced communication through online portals and mobile apps.

Info-Tech's approach to your claims system modernization journey

PROBLEM STATEMENT

1. High Volume of Claim Holds

80% or lower is the typical first-pass approval rate for manual claims adjudication (Therapy Brands, 2023).

2. Inefficient Manual Claims Processes

40-50% of claims are processed manually (Neudesic, 2025).

3. Integration Challenges With Existing IT Systems

20% of claims require rework due to errors ("Current State," HealthEdge, 2024).

| 1 Identify Key Trends and Industry Shifts | 2 Determine Business Needs and Capabilities | 3 Analyze System Features and Vendors |

|

1.1 Current Market Trends 1.2 Current vs. Modern Claims System Differentiators 1.3 Autoadjudication of Claims 1.4 Key Modernization Obstacles |

2.1 Source of Value for Claims System Upgrades 2.2 Use Case Evaluation With Sources of Value 2.3 Leverage Health Insurance Capabilities 2.4 Business Capabilities of Modern Claims Systems |

3.1 Key Features of Modern Claims Systems 3.2 Key Considerations for Selecting a Claims Product vs. Criteria for Vendors 3.3 Top Claims Adjudication System Vendors in the Market 3.4 Use Case Examples and Key Resources to Get Started |

Key Obstacles

- Data quality and standardization issues

- Regulatory compliance complexities

- Integration with legacy systems

- Fraud detection and prevention challenges

- High costs of manual processing

- Administrative complexity

- Data security and privacy concerns

- Resistance to change

- Technological growth

- Escalating healthcare costs

Info-Tech Insight

Modernizing claims adjudication is not optional - rising inefficiencies and financial strain demand action. Assess your processes, identify gaps, and choose an upgrade path before making a move.

Establish baseline metrics

Baseline metrics will be improved through:

- Decision Efficiency

- Compliance Rates

- System Performance

- Data Security and Privacy

- Cost Reduction

- User Adoption and Training

| Metric | |

| Decision Efficiency |

|

| Compliance Rates |

|

| System Performance |

|

| Data Security and Privacy |

|

| Cost Reduction |

|

| User Adoption and Training |

|

Guided Implementation

What does a typical GI on this topic look like?

| Phase 1 | Phase 2 | Phase 3 |

|---|---|---|

| Call #1: Scope claims system market trends, objectives of implementing a new claims adjudication system, and the challenges of adoption. | Call #2: Determine business needs and capabilities. | Call #3: Determine vendor evaluation criteria. |

A Guided Implementation (GI) is a series of calls with an Info-Tech analyst to help implement our best practices in your organization.

A typical GI is 3 calls over the course of 3 to 4 months.

1. Identify Key Trends and Industry shifts

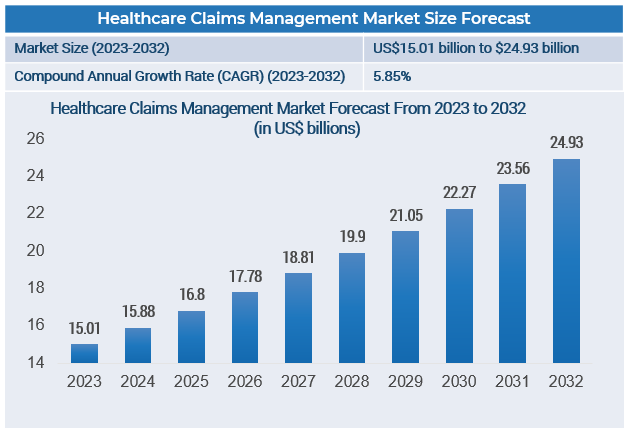

The healthcare claims management market is growing

Factors Impacting Growth

1. Expenditure and Insurance Coverage

Rising healthcare costs and a growing insured population have led to a higher volume of claims, necessitating efficient claims management systems.?

2. Technological Advancements and Digitalization

The integration of technologies like AI and automation enhances the efficiency and accuracy of claims processing.

3. Regulatory Compliance and Fraud Detection

Stringent regulations and the need to detect and prevent fraudulent claims drive the adoption of sophisticated adjudication systems.

Source: GlobeNewswire, 2024

Info-Tech Insight

Payers must prioritize intelligent automation, interoperability, and advanced analytics to remain competitive and meet the rising demands of digital-first healthcare ecosystems.

Choose your upgrade path

Whether payers choose to build, buy, or outsource their claims adjudication systems, selecting the approach that best aligns with their operational goals, budget, and technical readiness is key to reducing administrative burdens, minimizing denials, and improving accuracy across the healthcare payment lifecycle.

Build

Description: Payers can develop custom-built claims adjudication solutions internally, tailored specifically to their organization's unique processes, requirements, and existing infrastructure.

Benefits:

- Highly customizable and tailored to specific needs

- Full control over the system's functionality and data security

Challenges:

- Higher upfront investment

- Longer time to market

- Requires extensive internal IT expertise

Buy

Description: Payers can select and implement commercial off-the-shelf (COTS) or software-as-a-service (SaaS) claims adjudication solutions from specialized healthcare technology vendors.

Benefits:

- Faster deployment compared to custom-built solutions

- Regular, vendor-provided updates and regulatory compliance support

- Lower initial cost and risk

Challenges:

- Limited customization options

- Potential integration complexity with legacy systems

Outsource

Description: Payers can contract third-party service providers to manage the entire claims adjudication process externally, including infrastructure, software, compliance, and staffing.

Benefits:

- Highly customizable and tailored to specific needs

- Full control over the system's functionality and data security

Challenges:

- Higher upfront investment

- Longer time to market

- Requires extensive internal IT expertise

Health insurance payor transforms legacy claims with a custom, modern adjudication platform

A phased, custom-built approach drove agility, automation, and long-term flexibility in legacy system transformation.

INDUSTRY

Healthcare

SOURCE

CIO Interview, 2025

Health insurance company in eastern US

| Challenge | Solution | Results |

|

A major US health insurance payer faced growing limitations with its 45-year-old, mainframe-based claims adjudication system. The legacy platform lacked flexibility, was slow to adapt to regulatory changes, and required increasing manual intervention. Off-the-shelf system options were evaluated, but most solutions were either feature-heavy with unnecessary functions or would require extensive customization. The organization also had to address internal skill gaps, as transitioning away from the mainframe required upskilling or replacing personnel. Managing cross-functional alignment, stakeholder expectations, and system dependencies presented additional challenges. |

To meet its specific needs, the organization built a custom claims adjudication platform tailored to its specific business and operational needs over five years. The organization used a phased approach to enable gradual migration and reduce operational risk. Key success strategies included:

Automation and RPA streamlined workflows and reduced manual processing, while AI integration is still underway. Legacy systems remained as a fallback to ensure operational continuity during the transition. |

The new platform has delivered significant improvements in:

The phased approach, strong leadership alignment, and readiness to move forward despite imperfections were highlighted as critical to success. Ultimately, the organization positioned itself with a modern, agile infrastructure better suited to meet evolving payer needs and healthcare industry demands. |

Proactively align system selection with market trends

To effectively navigate the evolving landscape of healthcare claims adjudication systems, it's crucial to understand the current trends shaping the market.

| Market Trends | Actions and Insights |

| Analyze Market Growth |

Action: Examine the expansion of the healthcare claims management market to identify opportunities and anticipate future demands. Insight: The global healthcare claims management market is projected to grow from US$16.8 billion in 2024 to US$33.4 billion by 2033, reflecting a CAGR of 7.55% (IMARC Group, 2025) |

| Explore Technological Advancements |

Action: Investigate how emerging technologies like AI and machine learning (ML) are transforming claims adjudication processes. Insight: The adoption of AI and automation is enhancing accuracy and reducing processing times in claims management. |

| Monitor Regulatory Developments |

Action: Stay informed about legislative changes that impact claims adjudication practices to ensure compliance and mitigate risks. Insight: California's proposed Senate Bill 363 aims to increase transparency by requiring health insurers to report detailed data on treatment denials and modifications. |

| Address Administrative Cost Challenges |

Action: Evaluate strategies to reduce administrative expenses associated with claims processing. Insight: The US healthcare denial management market was valued at US$5.13 billion in 2024 and is expected to reach US$8.93 billion by 2030, indicating rising administrative costs (GlobeNewswire, 2025). |

| Embrace Real-Time Processing |

Action: Consider implementing real-time claims adjudication systems to enhance efficiency and improve stakeholder satisfaction. Insight: The shift toward digital and cloud-based solutions is driving the adoption of real-time claims processing, facilitating immediate decision-making. |

Recommended Steps

Conduct a Needs Assessment:

Evaluate your organization's specific requirements and challenges in claims adjudication.

Engage With Industry Experts:

Consult with technology providers and regulatory advisors to gain deeper insights into available solutions and compliance obligations.?

Develop an Implementation Plan:

Outline a strategic roadmap for adopting new technologies or processes, including timelines, resource allocation, and success metrics.

Leverage enhanced features to maximize impact

To fully leverage the benefits of modern claims systems, it's essential to understand the enhanced features driving innovation and efficiency.

| Features | Current (Legacy) Systems | Modern Systems |

| Claim Processing Speed | Manual or batch processing (days/weeks) | Real-time, automated adjudication (seconds/minutes) |

| Fraud Detection | Basic rule-based checks | AI-driven predictive analytics |

| Data Handling | Structured data only; limited for unstructured inputs | Supports structured/unstructured data, OCR, NLP |

| Interoperability | Limited integration; data silos common | Seamless, API-driven integration; FHIR-compliant |

| Compliance Management | Manual updates; delayed regulatory compliance | Automated, real-time compliance tracking |

| User Interface | Limited usability | Modern, intuitive UI with responsive design |

| Analytics and Reporting | Limited analytics capability; basic reports | Comprehensive, real-time analytics dashboards |

| Scalability | Limited scalability; rigid infrastructure | Highly scalable, cloud-based, adaptable |

| Security and Data Protection | Basic encryption; vulnerability to breaches | Advanced encryption, role-based access, security |

| Cost Efficiency | High costs due to manual processing and errors | Significant cost reductions via automation |

Embrace autoadjudication to accelerate claims efficiency

The healthcare industry is increasingly adopting autoadjudication in claims processing

Autoadjudication refers to the automation of the claims adjudication process, allowing claims to be processed with minimal to no human intervention by leveraging predefined rules and advanced algorithms.

How autoadjudication works:

Autoadjudication systems use advanced algorithms to evaluate claims against predefined criteria. The process involves:

- Data Validation: Automatically verifying the accuracy and completeness of claim information.?

- Rule Application: Assessing claims based on coverage policies, coding standards, and payer-specific guidelines.

- Decision-Making: Determining claim outcomes - approval, denial, or flagging for manual review - based on the automated assessment.

Benefits of autoadjudication:

Increased Processing Speed: Claims are processed in real time or near real time, accelerating payment cycles and improving cash flow for providers. ?

Enhanced Accuracy: Automation reduces human errors, leading to more accurate claim outcomes and fewer disputes.

Consistency: Applying uniform rules ensures consistent claim evaluations, enhancing fairness and predictability.

Resource Optimization: Freeing staff from routine tasks allows them to focus on complex cases and strategic initiatives.

Considerations for healthcare payers upgrading their claims systems:

- Data Quality: Ensure that input data is accurate and standardized to maximize the effectiveness of autoadjudication systems.

- System Integration: Seamlessly integrate autoadjudication systems with existing IT infrastructure to maintain interoperability and data flow.

- Staff Training: Provide comprehensive training to staff to manage and oversee automated processes effectively.

- Continuous Monitoring: Regularly monitor system performance and update rules to adapt to changing regulations and emerging trends.

- Patient Communication: Ensure transparent communication with patients regarding claim statuses and decisions to maintain trust and satisfaction.

Consider key obstacles to modernizing your platform

From legacy system integration and data standardization to regulatory complexity and internal change resistance, payers face a range of challenges when upgrading claims adjudication platforms - making it critical to plan for technical, operational, and organizational barriers from the start.

| Obstacles | Description |

| Business Disruption and Loss Risk | Modernizing claims platforms carries a high risk of business disruption - such as processing delays, revenue loss, or SLA breaches - that can directly impact operations, trust, and financial performance. |

| Data Quality and Standardization Issues | Inconsistent data formats and inaccuracies hinder automation, increasing manual intervention. |

| Regulatory Compliance Complexities | Evolving regulations demand adaptable systems, and noncompliance risks significant penalties. |

| Integration With Legacy Systems | Outdated platforms complicate integration, raising costs and complexity. |

| Fraud Detection and Prevention | Balancing thoroughness and efficiency in fraud detection mechanisms is challenging. |

| High Costs of Manual Processing | Resource-intensive manual processing significantly increases claims costs. |

| Administrative Complexity | Multiple stakeholders increase communication errors and processing complexity. |

| Data Security and Privacy Concerns | Protecting patient data is essential; modernization risks require robust security measures. |

| Resistance to Change | Traditional workflows cause stakeholders to resist new technology. |

| Technological Growth | Rapid technology advancements demand continuous system updates and training. |

| Escalating Healthcare Costs | Rising costs pressure insurers to adopt cost-effective claims management solutions. |