- You don’t know where to go next in terms of developing AI. It seems that AI is the “solution” to every problem, which creates misinformation/confusion in your firm.

- Your firm has limited AI experience. Few people have practical experience with AI because it is so new, and it is difficult to find someone to rely on in your firm.

- You need your AI efforts to create value. The implementation of AI will require a considerable investment in time and resources. It is important to track your firm’s efforts against the benefits it produces.

Our Advice

Critical Insight

- Wealth and asset management leaders have a limited understanding of the potential use cases and how to get started delivering new business capabilities to support strategic objectives.

- Your firm is concerned about the regulation and potential risks of AI. The regulation of AI can be complicated, especially in financial services and you must remain compliant with privacy laws, regulations, and policies.

- Firms don't prepare for AI development. AI requires mature data and systems capabilities that are often overlooked.

Impact and Result

- Introduce an approach to build your AI roadmap rapidly and responsibly via a six-step practical framework to accelerate the adoption.

- Help your firm to discover and understand a variety of AI use cases that can address your business challenges as well as support organizational strategic goals.

- Guide your firm on their AI journey by identifying and prioritizing AI use cases for business capabilities through a benefits realization model.

Build and Select AI Use Cases for Wealth and Asset Management

Prioritize AI use cases to transform your firm.

Analyst Perspective

The reach of AI is considerable across the wealth and asset management industries.

The wealth and asset management industries continue to be in a period of transformation. The traditional customer base is aging, and the transition of wealth is beginning to accelerate. At the same time, customer expectations are evolving. Younger customers expect different products and services delivered to them using new channels.

Customer expectations for ease of use, personalization, and responsiveness are rapidly escalating as challengers continue to compete with incumbents for assets with powerful and easy-to-use digital tools and experiences.

At the same time, the operational side of wealth and asset management businesses are experiencing cost pressures. They need to automate many legacy processes to reduce costs and elevate customer-facing services while remaining compliant with constantly increasing regulations, placing a greater focus on technology.

AI is an important focus for many wealth and asset management firms' senior leadership and boards. Everyone is aware of the potential of AI, and no one wants to be the firm that missed out on this important technology evolution. AI use cases are a good starting point to help firms understand what is possible and help to determine where your firm wants to start. They also play an important role in your broader AI strategy and execution processes.

David Tomljenovic MBA LLM CIM

Principal Research Director

Financial Service Industry Lead

Info-Tech Research Group

Executive Summary

Your Challenge

You don't know where to go next in terms of developing AI. It seems that AI is the "solution" to every problem that creates misinformation/confusion in your firm.

Your firm has limited AI experience. Few people have practical experience with AI because it is so new, and it is difficult to find someone to rely on in your firm.

You need your AI efforts to create value. The implementation of AI will require a considerable investment in time and resources. It is important to track your firm's efforts against the benefits it produces.

Common Obstacles

Wealth and asset management leaders have a limited understanding of the potential use cases and how to get started delivering new business capabilities to support strategic objectives.

Your firm is concerned about the regulation and potential risks of AI. The regulation of AI can be complicated, especially in financial services, and you must remain compliant with privacy laws, regulations, and policies.

Firms don't prepare for AI development. AI requires mature data and systems capabilities that are often overlooked.

Info-Tech's Approach

Introduce an approach to build your AI roadmap rapidly and responsibly via a six-step practical framework to accelerate the adoption.

Help your firm to discover and understand a variety of AI use cases that can address your business challenges as well as support organizational strategic goals.

Guide your firm on its AI journey by identifying and prioritizing AI use cases for business capabilities through a benefits realization model.

Info-Tech Insight

In many cases, the starting point for AI jumps to advanced solutions and capabilities. The reality is, there is considerable work to be done for your firm to be prepared to successfully introduce AI. The wealth and asset management industries have many closed/proprietary systems. They must be transformed to be more open and accessible especially for the data that resides in them. Assure your systems/data are ready for AI before you bring your implementations.

AI is an innovation in machine learning

Artificial Intelligence (AI)

A field of computer science that focuses on building systems to imitate human behavior. Not all AI systems have learning behavior; many systems operate on preset rules, such as customer service chatbots.

Generative AI (Gen AI)

A form of ML whereby, in response to prompts, a Gen AI platform can generate new outputs based on the data it has been trained on. Depending on its foundational model, a Gen AI platform will provide different modalities and thereby use case applications.

Audio – Converts text to sound.

Visual – Enables text to image, video, or web design conversions.

Code – Creates code in various programming languages based on human

language prompts.

Text – Creates text-based outputs such as articles, blog posts, emails, and

information summaries.

Machine Learning (ML)

An approach to implementing AI whereby the AI system is instructed to search for patterns in a data set and then make predictions based on that set. In this way, the system "learns" to provide accurate content over time (think of Google's search recommendations).

Info-Tech Insight

Many vendors have jumped on AI as the latest marketing buzzword. When vendors claim to offer AI functionality, pin down exactly how their AI works. The solution must be able to induce new outputs from inputted data via self-supervision – not trained to produce certain outputs based on certain inputs.

The wealth and asset management industries have already embraced AI

AI usage is in wealth management is growing rapidly. |

||

|---|---|---|

AI is already actively used in wealth management. Industry surveys reveal that 78% of wealth management organizations are already deploying client-facing and advisory-facing AI. The survey notes that organizations that haven't already adopted AI will face increasing pressure on their digital transformation requirements. Source: Itransition, 2025 |

35% |

The expected annual growth rate of AI use within the wealth management industry from 2021 to 2025. Source: Bobsguide, 2024 |

Wealth management executives believe they are ready for AI. |

||

The industry is experiencing tangible benefits from the adoption of AI. Firms who have adopted AI have seen a significant increase of 14% in productivity. The impact is also evident through an 8% increase in assets under management (AUM) and a 7% increase in revenues. Source: "AI Adoption Increases AuM," mdotm.ai, n.d. |

79% |

Percent of North American wealth management executives who believe their firms are "digitally ready" for the adoption of AI. Source: Accenture, 2022 |

The wealth management industry is adopting AI to drive growth and profitability

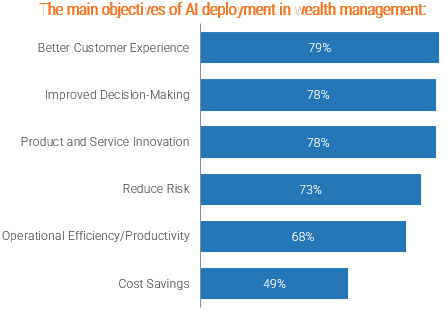

The wealth management industry is demonstrating that AI can drive growth and profitability, beginning with the customer. Offering better customer experience combined with product and service innovation has delivered AUM and revenue growth.

Wealth management firms are also using AI to drive efficiency, which has resulted in increasing productivity and reduced costs. The net impact is that AI is leading growing assets, revenues, and profitability.

Wealth management firms have less focus on cost savings than on driving customer experience.

Source: Itransition, 2025

The wealth and asset management industries are already realizing the benefits of AI

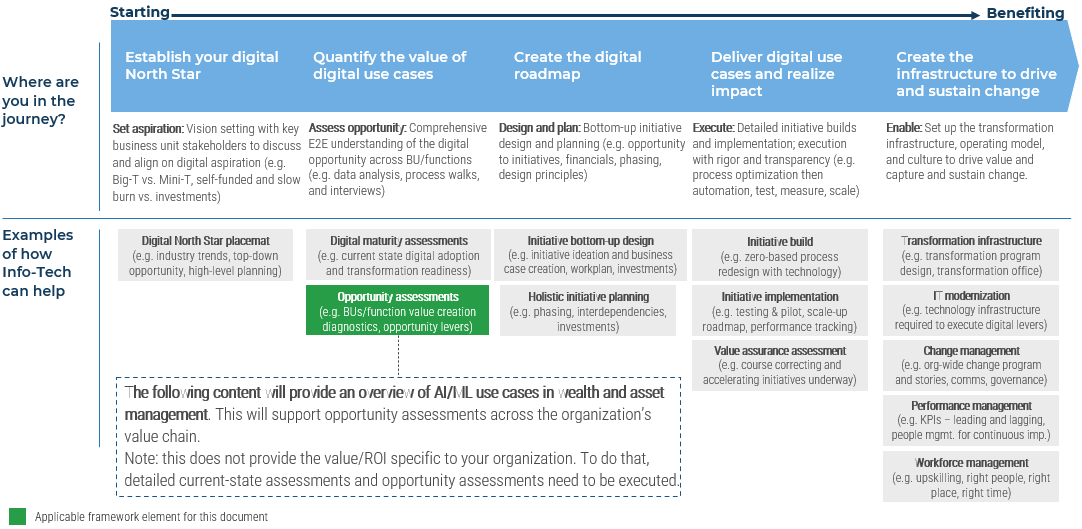

Info-Tech's approach and team can help, irrespective of where you are in your digital journey

How to use this report

Utilize this map to determine where to use this research material.

Visit Info-Tech's Build Your AI Strategy Roadmap blueprint for full activity details

This report is intended to act as both a standalone report on the AI opportunities within the wealth and asset management industries while also serving as a research-based accelerated input to the Build Your AI Strategy Roadmap blueprint and associated activities. It uses research-based data for "ACME Corp Data" to demonstrate AI use case opportunities for use in a holistic AI strategy and roadmap.

Realize all teams are unique and you may feel that some sample information may not be relevant to or represent your organization well due to the different type of products and services you are engaged in, geographic area you're located in, etc. We recommend that you adjust and customize the template as needed to be organization-specific and to create the most valuable AI strategy for your organization.

If using this report as a research-based accelerant input to the Build Your AI Strategy Roadmap blueprint, please use it in phases 2 and 3 and activities 2.1 and 3.1, specifically:

Phase 2 Identify AI Use Cases |

Phase 3 Prioritize AI Use Cases |

|---|---|

2.1 Map your candidate AI use cases |

3.1 Prioritize candidate AI use cases |

AI Strategy Roadmap Activities

Measure the value of this document

Document your objective.

Highlight best-in-class use cases to spur the initiative-planning and ideation process.

Measure your success against that objective.

There are multiple qualitative and quantitative, direct and indirect metrics by which you can measure the progress of your initiative pipeline's development. Some examples are:

- Increased initiative pipeline value.

- Number of capabilities impacted by initiative pipeline.

- Enhanced understanding of the initiatives' impact aligned to the organization's capability map.

- Better understanding of which sources of value are being addressed or under-addressed in the organization's initiative pipeline.

See Establish Your Transformation Infrastructurein the Digital Transformation Center for more details

AI in the wealth and asset management industries should produce measurable results

Outcomes |

Metrics |

Impacts |

Measures |

Increased Advisory Efficiency |

|

|

|

Reduced Operating Costs |

|

|

|

Increases Asset |

|

|

|

Increased Profitability |

|

|

|

AI Use Case Library Methodology

SECTION 1

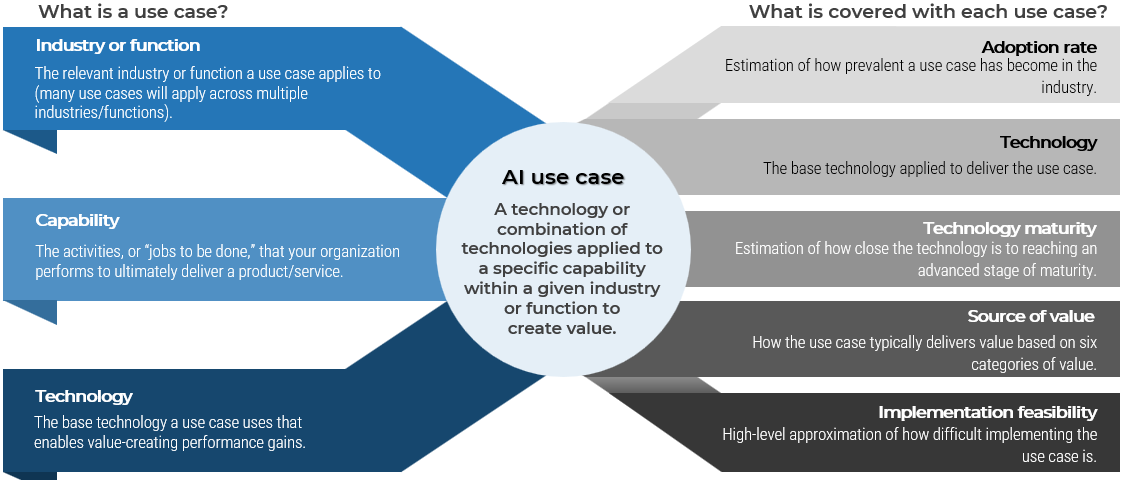

What is an AI use case?

An AI use case is a technology or combination of technologies applied to a specific capability (e.g. job to be done) within a given industry/function to create value.

Industry or function

The relevant industry or function (many use cases will apply across multiple industries/functions).

Capabilities

The activities, or jobs to be done, that your organization performs to ultimately deliver a product/service.

Technology

The base technology that enables value-creating performance gains.

The AI use case library

What is it?

A use case represents a technology or combination of technologies applied to a capability within a given industry or function that drives value. The AI use case library is a non-exhaustive list of Gen AI/AI/ML use cases that can be organized by industry/function, capability, or technology. The organizing principle in this document is by industry/function.

Why is it important?

In the context of a digital transformation, the Gen AI/AI/ML use case library:

- Identifies potential sources of value to analyze in a top-down opportunity assessment.

- Jumpstarts the idea generation process during the initiative development phase. Use cases are the foundational building blocks of the initiatives that ultimately deliver value to the business.

Use case

- Industry/ function

- Capabilities

- Technology

AI use case library

Leverage best-in-class digital use cases to build strong implementation roadmaps and maximize value creation.

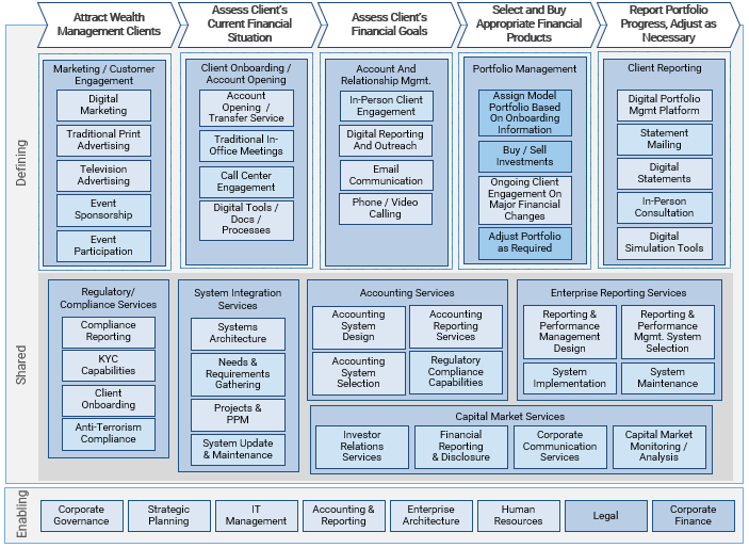

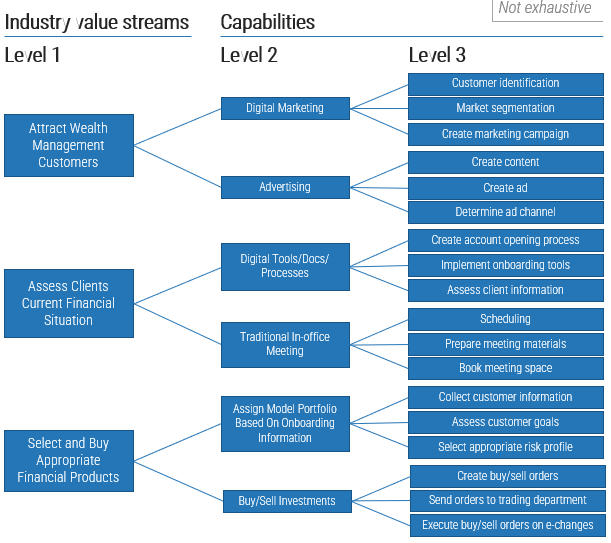

Leverage the wealth management capability map to identify candidate opportunities/initiatives

Business capability map defined …

In business architecture, the primary view of an organization is known as a business capability map.

Business capability defines what a business does to enable value creation, rather than how. Business capabilities:

- Represent stable business functions.

- Are unique and independent of each other.

- Typically, will have a defined business outcome.

A business capability map provides details that help the business architecture practitioner direct attention to a specific area of the business for further assessment.

Wealth Management: Industry + Capabilities Tree

Level 1: Value streams

Core components of an organization's value chain or support structure.

Level 2: Capabilities

The top-level activities that your organization performs to ultimately deliver a product/service.

Level 3: Sub-capabilities

The sub-activities, or jobs to be done, performed within an overarching capability.

2.1 Map your candidate AI use cases

1-3 hours

- Gather the AI strategy creation team and revisit your strategy context inputs, specifically your organization's business goals, business initiatives, value streams, and business capability map.

- Review the following top AI opportunity use cases for wealth and/or asset management and discuss possible AI use cases your organization can leverage to bring value. Try not to prioritize or score each candidate use case as that will be done in a subsequent activity. Rather, highlight, circle, whiteboard, sticky note, or use an online collaboration tool to keep track of your shortlisted and new use case ideas.

Download the AI Strategy & Discovery Presentation Template

Input |

Output |

|---|---|

|

|

Materials |

Participants |

|

|

Top AI Opportunities in Wealth Management

SECTION 2

AI use cases support wealth management strategy from sources of value

Use cases and resulting initiatives collectively support the organization's goals for adopting AI-based solutions.

Sources of Value |

|||||

|---|---|---|---|---|---|

Customer Experience |

Advisor Experience |

Operational Efficiency |

Risk Reduction |

Revenue Growth |

Cost Optimization |

Improving the customer experience with a product/service via reliability, engagement, transparency, etc. |

Enhancing the productivity of advisors so they have less low value tasks, leaving them to focus on customer facing/high value activities. |

Reducing costs through operational performance improvements. |

Using better tools to oversee high volumes of transactional and operational data to reduce the overall level of firm risk. |

Optimizing business processes to allow revenue generating activities to take priority over non-revenue-producing activities. |

By automating tasks, overseeing business processes to increase accuracy and to streamline processes. |